The US stock market plunged on Thursday following the White House’s clarification of a 145% tariff on China, escalating the trade war and rattling Wall Street. The Dow Jones Industrial Average had a volatile day, ending with a drop of 1,015 points, or 2.5%, after falling as much as 2,100 points earlier in the day. The S&P 500 fell 3.46%, and the Nasdaq Composite slid 4.31%.

This plunge came after the stock market had experienced significant gains earlier in the week. President Donald Trump’s “reciprocal” tariffs were paused briefly, but other import taxes have already impacted the economy. Following a brief victory lap, Trump acknowledged potential “transition problems.”

“A big day yesterday.

There will always be transition difficulty – but in history, it was the biggest day in history, the markets. So we’re very, very happy with the way the country is running. We’re trying to get the world to treat us fairly,” Trump said.

The US dollar index, which measures the dollar’s strength against six foreign currencies, fell 1.7% to its lowest level since early October. Gold prices, a safe haven amid economic turmoil, hit a record high above $3,170 a troy ounce. Traders were initially relieved when Trump temporarily rescinded his so-called reciprocal tariffs for 90 days.

Stock futures reacted positively to the European Union’s announcement that it would on the US for a negotiated trade agreement after Trump’s shift. Trump and Treasury Secretary Scott Bessent mentioned that more than 70 countries were lining up to negotiate trade deals with the United States to escape the tariffs. Despite this temporary reprieve, economists warn the economic damage has been done.

The comprehensive universal tariffs of 10% that went into effect on Saturday remain, as do the 25% tariffs on auto imports, steel, aluminum, and goods from Canada and Mexico. Future tariffs on pharmaceuticals, lumber, semiconductors, and copper are also pledged by the Trump administration.

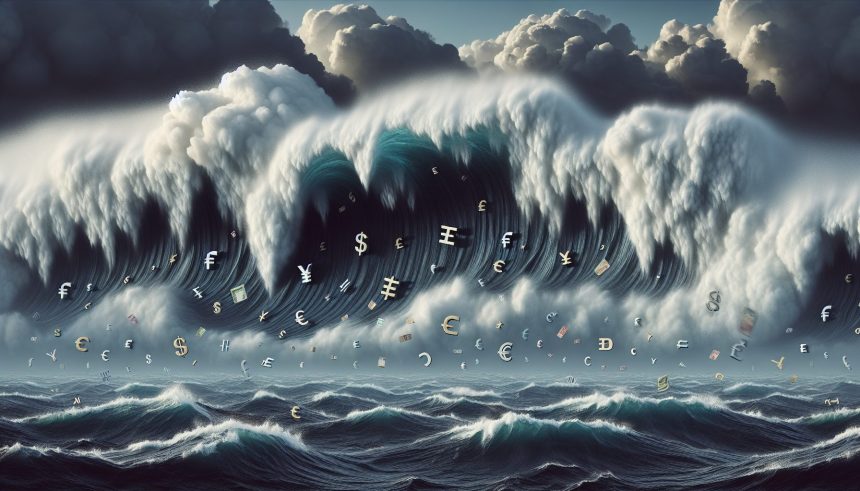

Market jitters amid tariff escalation

Goldman Sachs maintained that the recession odds in the US were still uncertain even after Trump’s partial detente. JPMorgan also estimated a 60% chance of a US and global recession. Joe Brusuelas, RSM’s chief economist, commented, “The US economy is still likely to fall into recession, given the level of simultaneous shocks that it’s absorbed.

All this does is postpone temporarily what will likely be a series of punitive import taxes put on US trade allies.”

The CBOE Volatility Index, Wall Street’s fear gauge, surged 40% on Thursday, temporarily trading above 50 points—a rare level indicating extreme volatility. Meanwhile, inflation in the US slowed sharply in March. While typically positive for investors, the focus remained on tariffs and their long-term economic impacts.

Adding to the financial market turbulence, Trump isn’t backing away from the trade war with China. Goods from China to the United States now face a 145% tariff. Additionally, Beijing’s retaliatory 84% tariffs on US imports to China went into effect, summing up the increasing tensions between the two largest economies.

“The door to talks is open, but dialogue must be conducted on the basis of mutual respect and equality. If the US chooses confrontation, China will respond in kind,” said a spokesperson for the Chinese Commerce Ministry. Beyond stock markets, bond markets and oil prices also reflected investor anxiety.

The 10-year Treasury yield surged past 4.5% before cooling slightly to above 4.3%—still a signal of market uncertainty. Oil prices dipped below $60 a barrel, with Brent crude falling 4% to around $63 a barrel. International stock markets saw mixed reactions.

Japan’s Nikkei 225 index ended more than 9% higher, South Korea’s Kospi rose 6.6%, while European stocks surged after announcements of potential negotiations. The ongoing trade war and market volatility underscore the high stakes and potential risk of recession, both in the US and globally.