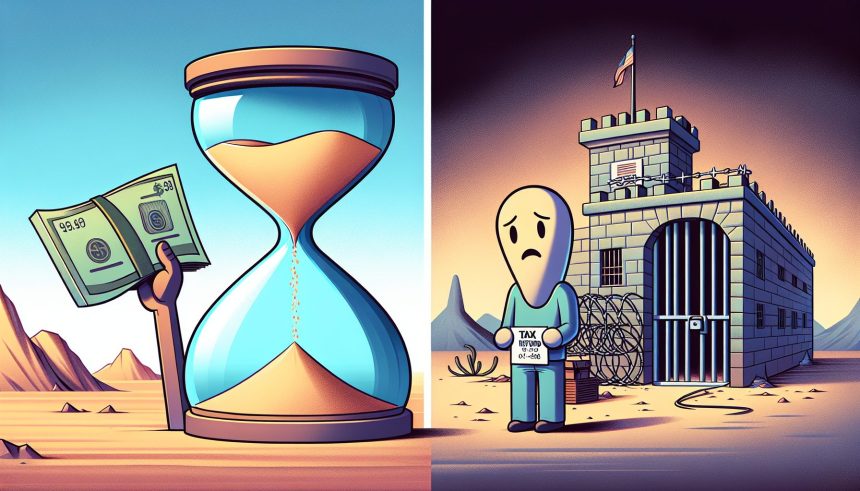

The fast-approaching budget agreement deadline for the House and Senate has raised worries over a possible government shutdown. This could potentially disturb those awaiting tax refunds from the Internal Revenue Service (IRS).

Amidst ongoing political tensions, legislators are pressured to reach consensus to prevent a shutdown scenario. As the deadline climbs closer, anxious taxpayers across the nation are uncertainty about how a shutdown may impact their anticipated IRS tax refunds.

In the event of a shutdown, agencies like IRS may temporarily pause operations, delaying the dispersion of tax refunds and causing financial disruptions for many households.

With the pending budget deadline not only a political issue but one affecting the everyday finances of many American citizens, it is now up to the House and Senate to formulate an agreeable budget plan, ensuring essential government functions, like IRS tax refund processing, continue without interruptions.

Attention turns to Washington as legislators aim to resolve the budget standoff. It is anticipated that concerns regarding the significant impact of tax refund delay on many citizens will encourage a prompt resolution.

Three weeks ago, Congress voted to extend the budget deadline, setting back the approval date for a federal expenditure bill of $1.2 trillion. With no agreement currently in place and the extended deadline expiring today, a government shutdown seems more probable. This fiscal year has seen four short-term financial agreements already.

Federal employees are left uncertain about their work status due to the ongoing impasse, with potential salary delays and non-essential service operational shutdowns. The negotiation sticking point seems to be disagreements over several pivotal funding divisions such as defense, education, healthcare, and environmental protection.

Potential shutdown could interrupt many vital services that Americans rely on daily extending from national parks to tax audits. To prevent this, some members of Congress proposed an additional temporary funding measure, akin to a fiscal band-aid that would prolong the current budget a few more days. However, support for this measure is questionable as it would be the fifth temporary measure this fiscal year.

A shutdown could cause temporary agency halts including the IRS.

Budget deadlock triggers tax refund anxieties

Taxpayers are concerned about how it might impede on their tax refunds. However, funding issues during tax season remain speculative as there’s no precedent.

In case of a shutdown, it’s unclear whether “essential” employees would continue to work on tax-related issues. This could lead to substantial delays for taxpayers waiting on refunds. The uncertainty adds pressure on lawmakers to find a resolution.

A shutdown could also influence the economy. It could affect economic growth and market confidence, which could then impact fiscal conditions. These impacts largely depend on the shutdown’s duration and severity, with shorter disruptions having lesser impact than prolonged ones.

Despite potential impacts, it’s important to remember that all potential effects are estimations at this stage. Without any prior instance of a government shutdown during tax season, financial analysts and tax professionals can only speculate potential outcomes. Citizens are therefore encouraged to continue filing and paying taxes as they would under normal conditions.

Those feeling uneasy can consult a tax professional or financial advisor for comfort. They can provide guidance on navigating potential tax processing delays and offer strategies for managing potential financial fallout.

In conclusion, while a shutdown might interfere with tax season, its precise impacts remain uncertain. As tax season continues, it’s crucial for taxpayers to stay informed about government developments and proceed with their tax filing process as standard, seeking professional advice if necessary.